Canadian Airline Industry: The Liberalized Protectionist

The Canadian Aviation Sector: The Liberalized Protectionist

Marty Thurston

Acronyms

ASA Air Service Agreement

CAI Canadian Airlines International

CATA Canadian Air Transport Association

CRM Crew Resource Management

FAA Federal Aviation Administration

FSNC Full-Service Network Carrier

FTA Canada-US Free Trade Agreement (1989)

GTAA Greater Toronto Airports Authority

IATA International Air Transport Association

ICAO International Civil Aviation Organization

JAL Japan Airlines

LCC Low-Cost Carrier

NTSB National Transportation Safety Board

SMS Safety Management Systems

WAA Winnipeg Airports Authority

In the past two years we have seen a larger degree of liberalization towards foreign-investment rights in the Canadian air traffic industry. However, Canada has been faced a number of challenges that are not conducive to further liberalization including a heavy tax burden, intense competition, dwindling stocks, American protectionism, safety issues, and poor policy coordination.

The current aviation policy framework consists of three overlapping layers. First, issues may be international, national, or sub-national in scope. Second, issues can be sector-specific, firm specific, or subsets of broader policy issues. Third, we can observe policy to be either pro-active or re-active depending on how government action addresses firm- or industry-specific regulatory issues.

This essay will begin with an outline of the major players in Canada’s airline industry and the distinctions between them. I will then discuss sector- and firm-specific challenges before comparing them with the reality of globalization. I will conclude by looking at the industry from an investment perspective in order to speculate on how these companies will look over the coming year.

Before discussing competition and foreign investment rights, it is useful to clarify what is meant when we say that Canada holds control of a firm. First and foremost there is a distinction between ‘regulatory’ control and ‘ownership’ control. Agency guidelines deem that Canadians ought to have ongoing power or ability, whether exercised or not, to determine or decide the strategic decision-making activities of an air carrier. So while equity might be held firmly by foreign investors, variable voting shares (or other regulatory tools) ensure that Canada remains the majority shareholder of voting and decision-making power.

Gialloreto discusses three models of business for carriers: (Clancy 220-21)

Full Service Network Carriers

Air Canada is defined as an FSNC in part because it is a legacy carrier that has survived through restructuring where many others have not. It has high legacy costs that have weighed it down not entirely unlike General Motors. FSNCs are usually responsible for a majority of the international and corporate business travellers. Air Canada’s cost structure has made the company particularly vulnerable to regular operating risks. Another challenge is union action affecting legacy carriers like Air Canada. Wage concessions and strikes have been highly visible in the airlines compared with other sectors. Unions have a deceptive amount of power and this case has been very true in Canada and the U.S. This is where the smaller carriers like Westjet and Porter have the distinct advantage of being non-union.

Low-Cost Carriers

These carriers have succeeded internationally due to reduced expenses, flexible work forces, and strict debt-management. They are usually limited to regional routes, with minimum international capacity, but we are starting to see a new business model that incorporates hotspot destinations internationally and nationally, while operating within a low-cost structure. LCC fares are typically a quarter to a third cheaper than FSNCs, but this is made up for by high volumes of occupancy. LCCs also sometimes acquire a regionally-based support, in which they may be seen as a regional flag carrier. We might say that the emergence and success of the LCC business model was a re-active strategy against many failing and cash-strapped FSNCs. Both Westjet and Porter had begun as LCCs, but both have since expanded significantly. Westjet is no longer regional, offering even some select international flights, and Porter has been looking closer at Western Canada and the North-Eastern U.S.

It is interesting to watch how Porter has developed as an airline over the years because their business model is beginning to look like what Clancy has referred to as a low-cost/medium-differentiated service model. Clancy is vague about these services but he claims that, “Over time, firms attempting this transition proved unstable or short-lived, and the relevance of this third option can be questioned.” (221) I think that this business model is relevant, insofar as that there were definitely extenuating circumstances beyond the LCC structure Porter began with. They have not only enjoyed the regular advantages of the LCC business model, but hold a virtual monopoly over Billy Bishop Airport (Toronto City Centre Airport), have had some success through litigation, low landing fees, as well as cheaper labour costs due to no workers union. Porter proved successful in understanding the ‘use or lose’ principle – that carriers who fail to operate licensed routes risk having them cancelled and reallocated to competitors. Indeed, Billy Bishop was losing a million dollars annually with AC Jazz flights before Deluce stepped in. As a growing company in unfamiliar waters, the next major challenge for Porter will be not expanding too quickly or they could risk allocating a large percentage of their resources too broadly.

Broad-Based Challenges

Some of the challenges facing the Canadian air traffic industry include things like normal operating risks that fall fairly uniformly over all carriers. For carriers with high legacy costs, like Air Canada, these operating risks are usually greater. Airlines are extremely capital intensive, and are regulated heavily. Things like the price of fuel and corporate debts are important because they are a function of the business model and firm history. Something that is uniquely Canadian would be the government fees and tax burden that are passed directly to the consumer. This aspect makes Canada’s competitive potential significantly out-of-line with competition. The Federal Excise Tax on Aviation Fuel was originally introduced during times of record deficits, but these deficits have been gone since 1998 and now the tax acts as an extra disadvantage for Canadian carriers compared to their American counter-parts. “The U.S. tax is thus three times lower than the Canadian excise tax.” (Giume, 4) With a majority of the population located along the border, if Canadian consumers are unwilling to swallow the tax burden they might look elsewhere for their flying needs.

“The specific contribution of the air transport sector to the federal treasury rose by an annual average of 19.6% between 2000 and 2005, reaching $793 million in 2004-05. This sharp rise came mostly from the 2002 introduction of the air travellers’ security charge introduced after the attacks of September 11, 2001.” (Giume, 1)

There is also a structural aspect that has challenged most North American carriers. The claim is that too many carriers are making too many flights, and this is particularly true in the United States. This causes ultra-competitiveness, and is part of the reason companies pursue alliances and consolidations. Post-9/11 security policy has been slow to increase the amount of foreign-owned air traffic with Canada, which may or may not be justifiable but leaves little room for reciprocal foreign-ownership restrictions. This appears to be changing as Delta eyes up JAL in Japan but it may take some time before the trend is picked up elsewhere.

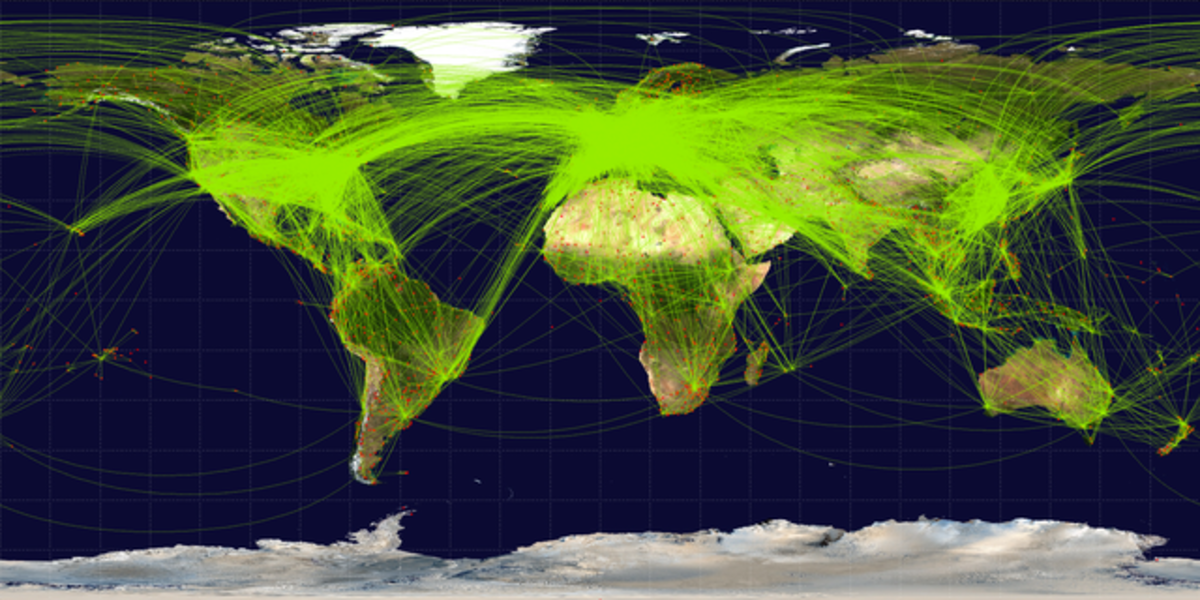

There has been a significant degree of internationalization of major airlines through inter-corporate alliances – which has been a re-active function of some of the issues listed above. Some have forecast that this will lead to a global ‘shakeout’ of a few leading global carriers which form the first tier, next to isolated national carriers as second-tier firms. Most FSNCs operate with inter-corporate alliances, which will become even more important for further international liberalization.

Industry Competition

Competition rules in the airline industry are significant relative to other sectors. Foreign ownership limits do not exist to the same degree in things like media and television competition in Canada; it is quite easy to pick up an American newspaper pretty much anywhere. This begs the question, who should competition policy ultimately serve the corporation or the consumer? Australia’s Qanta was acquired by Virgin Blue; providing cheaper airfare to the consumer without destroying the economy. The public is interested in whichever airline saves them the most money, and that is definitely a concept that applies across-the-board throughout the industry. These competition rules reflect the Competition Bureau’s efforts to push its jurisdiction further into regulated industry sectors.

Publicly-traded carriers like Westjet and Air Canada are expected to increase foreign ownership restrictions from 25% to 49.9%. Part of the argument from the perspective of Canadian carriers has been that they welcome competition, but are facing discriminatory practices by way of landing fees, terminal charges, and a heavier tax burden. As of October 2009, Pearson International has reduced costs to airlines for the third year in a row, estimated to save around $58 million. This is part of the GTAA’s 10-year Airport Development Program. This is an example of an ‘offensive’ action intended to address industry-specific regulatory issues, while trimming the fat at the same time. Unfortunately, Pearson has a lot of fat to trim and was the world’s most expensive airport to land a Boeing 747 in 2006, overtaking Narita airport near Tokyo.

Canada-U.S. Relations

Clancy describes that, “traditionally, a bilateral ASA sets the parameters of the international airline business. It enumerates the routes to be flown (e.g., the Canada-US bilateral agreement lists more than 50 city pairs) and the fare structures which apply (normally be reference to International Air Transport Association schedules)”. (242) A more liberalized climate has and will continue to acknowledge ASAs that promote unrestricted bi-national access between countries through all routes, encouraging price competition across-the-board.

One important observation is that Canada and the U.S. do not trade together, they make things together. This speaks to the magnitude of intra-firm trade going across borders. Post-9/11 ‘security’ policies might just as well be called post-9/11 ‘protectionist’ policies because they have effectively hampered most definitions of ‘open skies’ between Canada and the United States. On the international front, the recent U.S. ‘open skies’ agreement with Japan, means there is finally a good precedent for some international aviation policy progress. If American or Delta acquires Japan’s largest carrier JAL, Canadian carriers will be pleased with the prospect of greater access to cross-border policymaking and have already been eyeing-up suitors.

However, it is not fair to claim that the U.S. is the reason Canada has had difficulty liberalizing its aviation sector, because Canada has been sitting on the fence as well. On November 16, Canada was the odd-man-out at an AITA summit standing against countries like the U.S., Chile, Malaysia, United Arab Emirates, and the European Commission, who signed a carrier liberalization agreement that aims to reduce restrictions that prevent companies from having access to capital markets.

Barry Rempel, chairman of the Canadian Airports Council and president and CEO of the WAA claims that Canada’s public commitment to ‘open-skies’ has been undermined by underlying protectionist principles. Due to what Rempel considers a lack of operating flexibility, Singapore Airlines exited Canada last year. “With Singapore went hundreds of jobs. Vancouver Airport Authority estimates that just one daily flight by a new Asian carrier contributes $17.4-million in direct benefits, including 221 jobs.” (Rempel)

Policy Issues and SMS

“In most decision-making processes, there comes a decisive moment when one possible outcome gains ascendancy over its rivals.” (Clancy, 255)

Assuming that nation-states control the airspace within their borders, policies often reflect the complexity of individual route networks within nation-states. Policies will vary significantly between, for example, a state with only one major port of entry/exit, compared with a country like Canada where there is not only a broad range of ports, but also a larger number passengers who are passing through to other destinations.

Safety Management Systems (SMS) have been a controversial policy feature of the airline industry in recent years. SMS effectively forces the airline industry to enforce its own standards of safety, which is then monitored by the government. From a risk management perspective this has important consequences. Some see the government to be ‘passing the buck’ in a self-serving nature, while proponents claim that SMS is an additional layer of security without affecting old standards. It appears that the argument relies largely on the auditing process; if the government can afford to conduct proper audits, then technically, not much has changed from the old formula. If, on the other hand, government replaces surprise auditing with policy evaluation/monitoring, then former Judge Virgil Moshansky has it dead on – “It’s like the fox running the henhouse.” SMS has been implemented in the railway system for years, and there have been numerous examples of accidents that might have otherwise been prevented. In 2006, Tom Dodd and Don Falkner were aboard a runaway CN train as it plunged off of a British Columbia cliff because of ineffective brakes. The safety board concluded this year that the decision to install brakes not meant for mountainous terrain was a financial one and not for safety reasons, even though it went against company policy. “A review of the [railroad] industry’s safety management policy released in 2008 concluded that the implementation of the policy had been inconsistent across the country and said Transport Canada hadn’t dedicated enough resources to oversee it.” (Theodore) It might not hurt to make the distinction here that trains mostly transport goods, where planes mostly transport people.

SMS is an important policy debate because it redefines the notions of safety and risk management. Some have gone as far as claiming that SMS in the aviation industry is similar to de-regulation in credit markets. Obviously the lesson is that an ‘operator’ should not be given the discretion to define what they consider an acceptable level of risk. SMS is not a new concept, as crew resource management (CRM) has been in practice with limited success for a number of years. SMS is an identical concept to CRM, only practiced on a managerial level. Considering the limited success of CRM, historical trends within the rail industry, and operation limitations of Transport Canada, we need to be very mindful of SMS in the next year which will be a time of recuperation for air traffic.

SMS is outcome-based legislation, and today is a particularly scary time for this reality. Since overall levels of air traffic had dropped so profoundly through the recession, there were less problems, near-misses, and incidents, leading some to believe that airlines were safer than they might in fact be. Since SMS is mandated by the ICAO, it is here to stay, although cracks in the system may not become visible until air traffic has resumed pace over the following year. Even now though, there have been reports of masking tape holding together hotwired dash panels, Canadian Tire-grade nuts and bolts, and hot-refuelling with passengers on board. This goes without blaming the pilots or crews because in the third scenario, they were legally restrained to keep the passengers in the plane, but did not have a ground-source of energy to refuel, and had to keep the engines going. The political reality is that it does not matter who is at fault; you can cut costs in just about every other area except public safety.

Public Safety

Deborah Hersman, Chairwoman of the NTSB, has argued that runway safety and pilot fatigue issues have been largely ignored since first being brought to attention in July 2000. “It has taken over nine years to achieve partial acceptance of recommendations made in an area, runway safety, that is viewed as critical by both the FAA and the NTSB, we really need to do better than that,” said Hersman in prepared remarks. These concerns have been illustrated after an October 19 landing of a Delta Airlines Boeing 767 on a taxiway in Atlanta. While no one got hurt, a jet of that magnitude, moving that quickly, over the wrong part of a very busy airport screams for better risk management operations.

The NTSB released two near-miss animations that were brought to attention in a board meeting in 2007. These animations include audio and a three-dimensional recreation of events. Either one of these accidents would have consequences of great magnitude, and they can be viewed at the NTSB.gov website with a specific link listed in the bibliography. While increasing safety for pilots and runways is a universally agreeable notion, the challenges in adapting policy can have many fronts. One needs to distinguish whether the challenge is rooted in rule-making, changes to law, or immature forms of technology that can not yet be reasonably implemented. One could make the point that SMS has encapsulated all three. While some have argued that major runway incursions have dropped recently by more than 50 percent, Hersman is convinced that this is simply because of a recession-driven decline in air traffic. If this is true, then SMS, runway safety, and pilot fatigue issues should be at the forefront of any restructuring taken by the airlines over the next year or two. Due to the recession, it is difficult to gauge how responsive current risk management practices are, and since there has been a large reduction in air traffic, these are significant hazards that could be lurking under the surface.

Aerospace Manufacturers - Bombardier

In late-November 2009, Bombardier announced they would have to cut 715 jobs in the Montreal area because of lack of interest for buying aircraft. Unlike the major carriers, aerospace manufacturers are going to take much longer to bounce back than the airlines. It will undoubtedly take time for the major carriers to be in the position to put orders for new aircraft, and it could be two or more years before aero-space manufacturers catch up with the rest of the industry. This will admittedly be truer for those manufacturing companies who are not floated by military contracts. The stock price for airline companies might increase, but significant capital spending will lag behind until those earnings can be realized. The Q400 Turboprop has been such a successful aircraft because it is much cheaper than the big jets, and demand for the Q400 is supported by a broader range of pretty-much-inevitable orders from Porter, Jazz, as well as European countries, the Middle East, etc. Bombardier has been diversifying their interests and recently has been talking to major Middle Eastern airlines about supplying 100- to 149-seat CSeries jets. While these are good linkages to be making, the opportunities to capitalize on these offers will not be realized until major airlines are well into the recovery process. Bombardier’s stock may be a decent long-term option, but there are many contingencies that increase overall risk from the aero-space manufacturing sector.

Business Perspective

Although it is highly cyclical, the airline industry can also be very volatile, which has led analysts to develop strategies to encourage investment. Some American analysts have used the ‘down 30 in30’ rule concerning the market activities of Continental Airlines and American Airlines’ parent, AMR Corp. If shares in either company drop 30% within 31 days of trading, a correction is likely within 180 days of trading. It should be noted that while these types of strategies can generate huge windfall opportunities for the investor, it is very difficult to identify the ‘top’ and ‘bottom’ of the market cycle in this industry.

Coming out of the recession, it is not uncommon for passenger traffic to increase dramatically. It is generally safe to argue that the market cycle has already weathered the worst lows, and by all reasonable accounts should see some forms of growth/stabilization in the aviation sector. This is especially true for Westjet, with low cost structure, and promising diversification. “[Westjet’s] new reservation system, implemented Sept. 2009, will allow it to launch its new loyalty program early next year and implement four new code-share agreements next year, including with Air-France-KLM, British Airways PLC and Southwest Airlines.” (Deveau)

While Westjet is the safer bet, some investors have been tempted to gamble with Air Canada, likely considering the fact that a stock trading at less than $1.50 a share would become significantly profitable with even the most modest amounts of sustained recovery. On December 3, Air Canada received ‘approved destination status’ in China, which effectively means it will add daily service from Toronto to Vancouver and Beijing and Shanghai year-round. Previously these routes have been limited to a few days a week out of the peak season. An underlying assumption here is that Canada will actively pursue relations with China; Chinese Premier Wen Jiabao was not out of line by claiming Canada’s recent visit was long overdue, and hopefully Harper got that message.

Conclusion

It will be interesting to watch how the Canadian Airline industry will evolve in the New Year. At the high-end of the spectrum, I believe progress could be made through landmark international and foreign ownership policies that would alleviate some pressures on airlines and put them in a competitive environment to make sustainable recoveries. At the low-end of the spectrum, some business models may be becoming obsolete, or perhaps the entire concept of a generic business model is becoming obsolete in today’s aviation world. There are also some issues about safety that will have to be dealt with because risk-management is such an integral part of the airline industry. State policy regimes ensure that national, sub-national, and international actors must operate in a multivariable environment that is heavily regulated, which means that in order for Canada to remain competitive and profitable, it will have to advocate foreign-ownership liberalization to the best of its ability.

References

Burney, Derek (2009), “Managing Canada U.S. relations: A case study at 30,000 feet”, National Post, 5 May, A15.

Clancy, Peter (2004), Micro-Politics and Canadian Business: Paper, Steel, and the Airlines (Peterborough, ON: Broadview Press)

Cohen, Andrew (2009), “Why Porter should carry on”, The Ottawa Citizen, 8 September, A10.

Deveau, Scott (2009) “Airline Recovery on the Horizon”, Financial Post.

Giuame, Stephanie (2006), “How to make the Canadian Airline Industry More Competitive”, Tax Policy Series, Montreal Economic Institute.

Hale, Geoffrey (2006), Uneasy Partnership: Business and Government in Canada (Peterborough, ON: Broadview Press)

Jang, Brent (2009), “Canada seeks airline ownership reciprocity”, The Globe and Mail, 9 October, B6.

Jang, Brent (2009), “The problem according to IATA: Too many airlines”, The Globe and Mail, 16 September, B1.

NTSB Crash Animations - http://ntsb.gov/Publictn/animations.htm#AS

Rempel, Barry (2009), “Open the Skies”, National Post.

Theodore, Terri (2009), “New Rules for Aviation Safety a Flight Plan to Disaster, Critics Warn”, Canadian Press, Aug 23, 2009.